Credit Floor Error Message

The issuing bank has declined the transaction as this card cannot be used for this type of transaction.

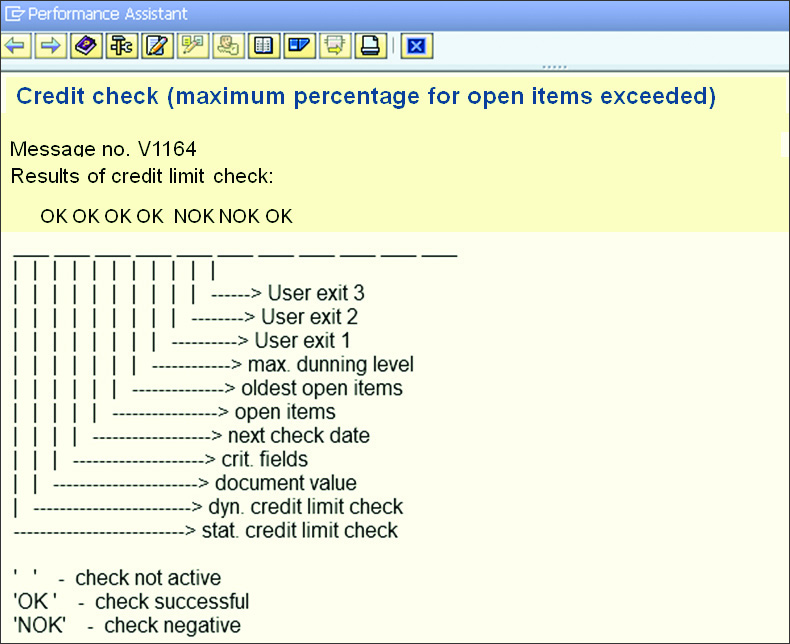

Credit floor error message. Dpo 2018 suite 3 ulysses house foley street dublin ireland 353 1 8764849 africa hq. 254 708 480275 254 706 358022 a merchant s guide to credit card failure codesa merchant s guide to credit card failure codes. The new method when you make a payment for your internet accounting use apart from adding the payment to your credit limit we now also set another field in the system called the credit floor. Ask the customer for using another card or contacting their bank.

The transaction is declined by the issuer as the credit card number doesn t exist. Total merchant concepts provides the most common codes along with the response reason. The floor limits usually come into. Message reads we encountered a paymentech problem.

Function not permitted to cardholder. In credit card purchases the maximum amount the merchant can charge to the buyer s card without getting authorization. The customer should use a separate credit card. For a charge above the floor limit the merchant must obtain authorization from the card issuer.

Whatever point of sale system you use it should deliver a specific code number along with the decline receipt but that won t help give you the why without having the definitions of those codes. Declined credit cards are a common occurrence in any business environment but they are especially common in b2c high transaction volume companies. It is set to the value of your balance truncated to whole dollars at the time of payment. Response codes received that are not in this table should be treated as a general error not approved.

A zero floor limit means every credit card transaction has to be authorized. Im trying to buy a thing for 66. While an increased spend on credit cards has led to a surge in the number of e payments being processed every day it has also given rise to some challenges for the users and businesses alike. Credit card statistics say that as of july 2020 there are 1 06 billion credit cards in use in the united states of america alone and 2 8 billion credit cards in use worldwide.

Credit cards can be declined for numerous reasons.