Current 30 Year Fixed Mortgage Rates Michigan

Click the lender name to view more information.

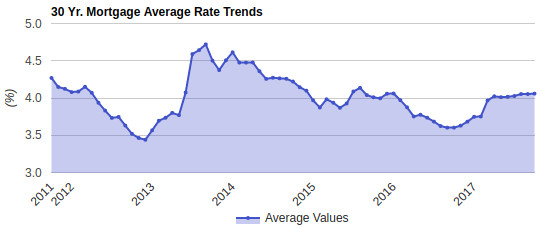

Current 30 year fixed mortgage rates michigan. Michigan 30 year fixed mortgage rates 2020. Assumes today s average rate 30 year fixed 720 credit. The difference can be as large as a full percentage point. At present the mortgage rates in michigan for common loan types are.

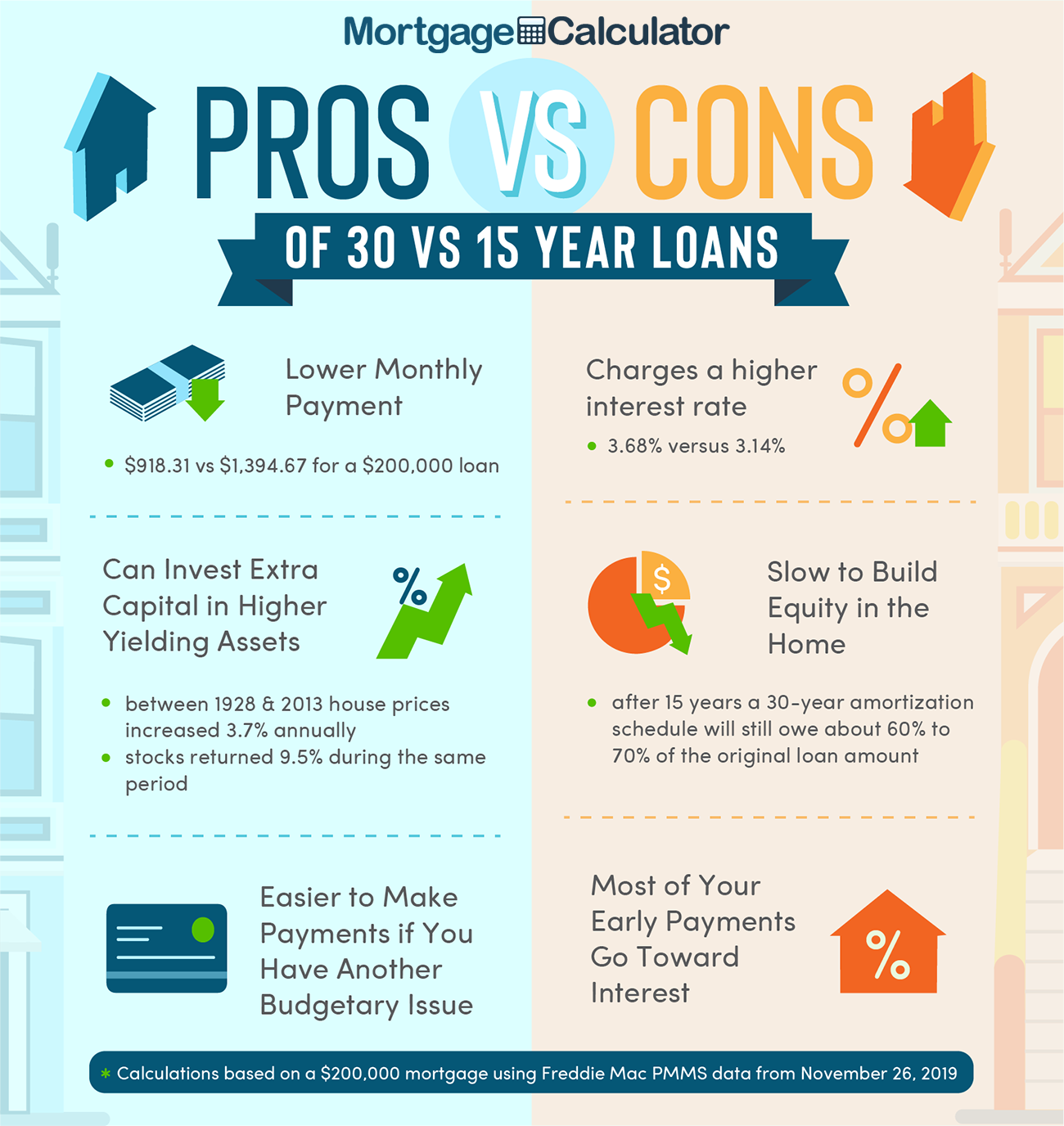

Loans with less than 20 down payment may require private mortgage insurance. The downside of this however is that the apr is higher compared to shorter term loans. Learn more about today s mortgage rates. Rates based on a 30 day lock.

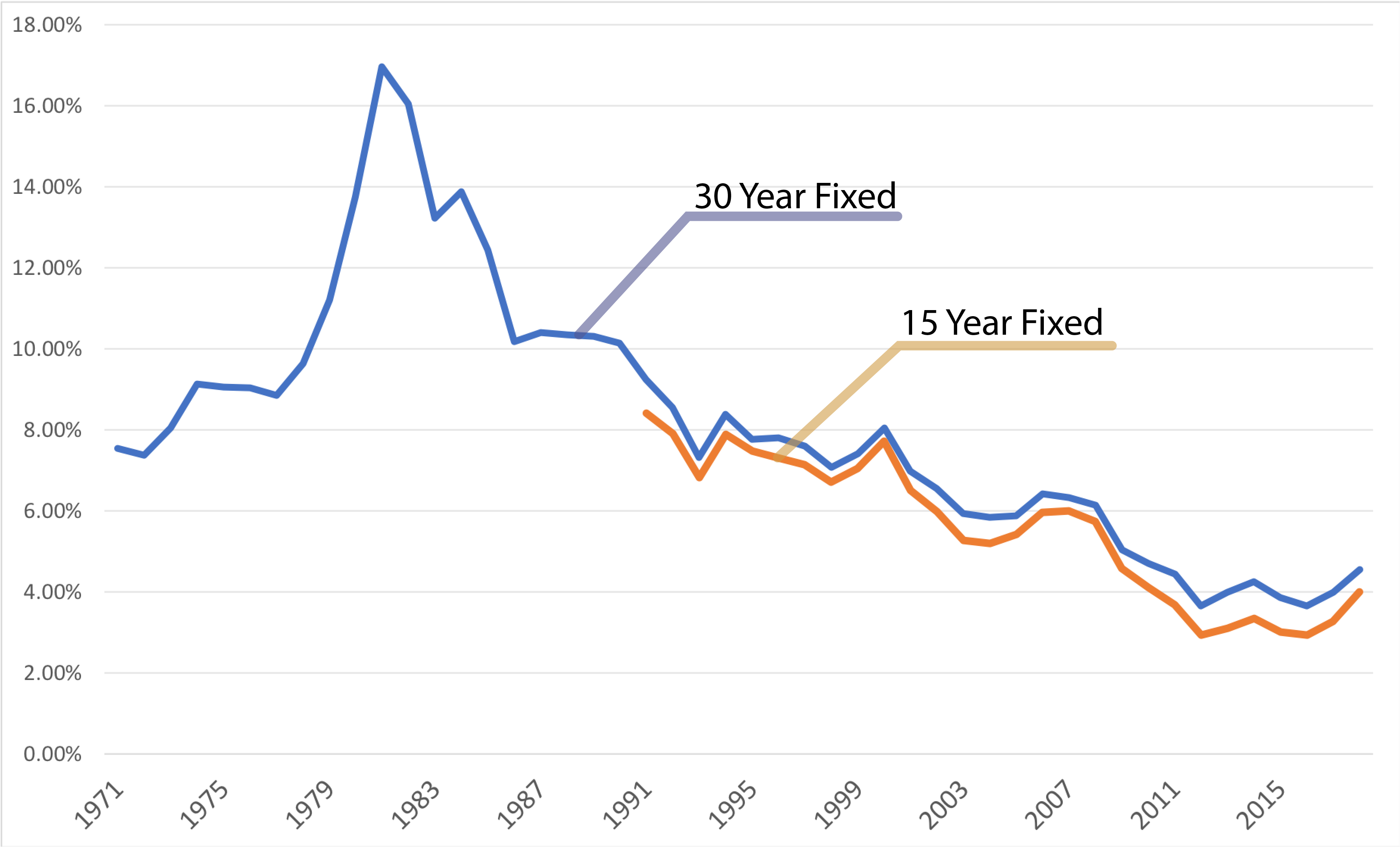

In addition to conventional 30 year and 15 year fixed rate mortgages. Assumes today s average rate 15 year fixed 720 credit score 3 5 down or home equity and other common loan terms as seen here. Rates vary based on market conditions and are subject to intraday market changes. 30 year fixed 15 year fixed 10 year fixed 5 1 year arm and etc.

Current rates in michigan are 3 10 for a 30 year fixed 2 62 for a 15 year fixed and 3 41 for a 5 1 adjustable rate mortgage arm. Current rates in michigan are 3 018 for a 30 year fixed 2 757 for a 15 year fixed and 3 086 for a 5 1 adjustable rate mortgage arm. Check out our other mortgage and refinance tools lenders. Rates and fees may vary and are based on credit history down payment property type and other factors associated with your loan application.

2 98 for a standard 30 year fixed loan 2 42 for a 15 year fixed loan and 2 98 if you are considering a 5 1 arm. On saturday october 03 2020 according to bankrate s latest survey of the nation s largest mortgage lenders the benchmark 30 year fixed mortgage rate is 3 050 with an apr of 3 360. The longer the life of the mortgage the lower the monthly payment will be which is why the 30 year loan is the most popular. Compare michigan 30 year fixed conforming mortgage rates with a loan amount of 250 000.